dollar index, USD index, greenback, dollar strength, FX sentiment, yields

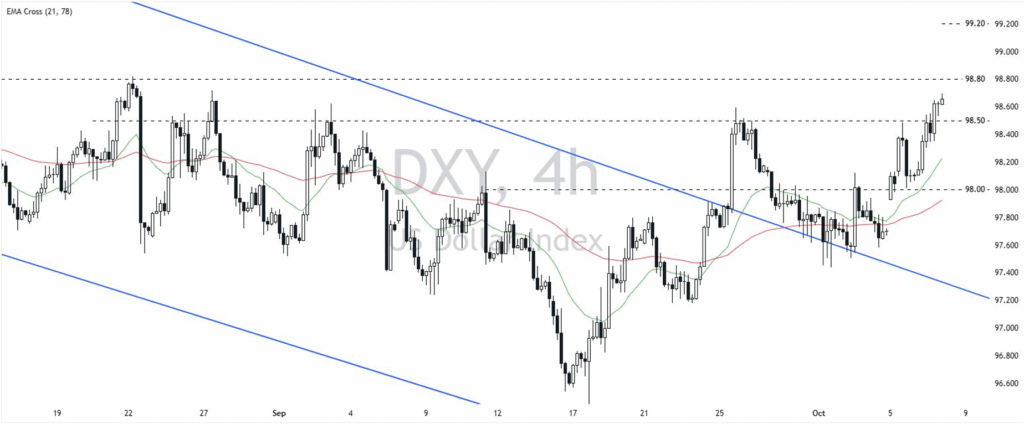

US Dollar Index (DXY) held firm above key support at 98.50 after a close near 98.62. The near-term structure stays constructive while buyers defend 98.50, with 98.80 and 99.20 in focus on strength. A daily close below 98.00 would neutralize the bullish tone.

Sticky inflation expectations and firm US yields continue to underpin the greenback. Divergent growth signals across Europe and Japan keep safe-haven demand in play, helping dips in the US Dollar Index attract buying interest.

Price action above 98.50 (S1) keeps momentum positive. Acceptance and a daily close above 98.80 (R1) would open the path toward 99.20 (R2). Failure to reclaim 98.80 on rebounds risks a retest of 98.00 (S2).

| Instrument | Close | Supports | Resistances | Trade Idea |

|---|---|---|---|---|

| DXY | 98.62 | S1: 98.50 • S2: 98.00 | R1: 98.80 • R2: 99.20 | Buy dips above 98.50 → 98.80 then 99.20 • Invalidate on daily close < 98.00 |

As long as 98.50 holds on a closing basis, the path of least resistance tilts higher. Watch incoming inflation data and Fed communication for confirmation. A break and close below 98.00 would shift risks back to a broader range.

How can I use these levels effectively?

Treat them as reference zones for planning entries and exits. Always confirm with live quotes and your timeframe signals before execution.

What invalidates the short-term bullish bias?

A decisive daily close below 98.00 would neutralize the constructive view and argue for range consolidation.

Do these levels change intraday?

Levels are reviewed against the latest 12-hour price action; update with live data on your platform when conditions shift.

Note: Confirm live quotes on your platform before trading. Levels: Close 98.62 • S1 98.50 • S2 98.00 • R1 98.80 • R2 99.20.