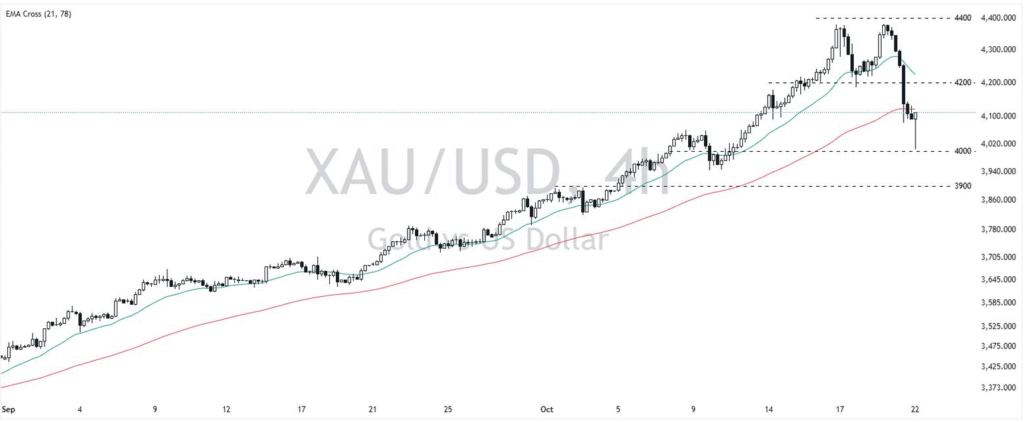

XAUUSD Analysis – October 22, 2025

The XAUUSD analysis October 22 2025 shows that gold prices continued to decline on Tuesday, pressured by profit-taking and a stronger US dollar. According to Exness market data, spot gold fell for a second consecutive session as investors reduced exposure to safe-haven assets amid improving risk sentiment.

From a fundamental perspective, optimism over renewed US-China trade discussions and easing geopolitical tensions weighed on gold’s safe-haven appeal. Meanwhile, expectations that the Federal Reserve will keep interest rates higher for longer have strengthened the US dollar, adding additional downward pressure on XAUUSD.

Technically, gold remains under short-term bearish control after breaking below both the 20-day and 50-day exponential moving averages. The price is consolidating near the $4,000 level — a critical psychological support zone. A confirmed daily close below $4,000 could trigger a move toward $3,900, while resistance lies near $4,200.

The RSI indicator hovers near 45, suggesting a neutral-to-bearish bias, while MACD signals remain negative. Overall, the technical setup favors short-term sellers unless buyers reclaim the $4,200 resistance area.

The current XAUUSD analysis October 22 2025 suggests that sentiment remains mixed, with traders waiting for upcoming inflation data and potential comments from Federal Reserve officials. If inflation cools, gold may see temporary support, but a stronger dollar and rising Treasury yields continue to cap upside momentum.

For AI-powered forecasts and real-time market insights, visit Smart Trader Pro — the official AI trading assistant from ForexMarketPlace.

Disclaimer: Market information and analysis derived from Exness daily reports, verified on October 22, 2025. This content is provided for educational purposes only and should not be considered investment advice.

Trade gold and other assets with Smart Trader Pro — your AI-powered tool for accurate trading insights.

Try Smart Trader Pro