Euro vs US Dollar Technical Analysis – EURUSD Key Levels-24-10-2025

Euro vs US Dollar technical analysis shows that EURUSD remains under mild bearish pressure, trading near 1.1528 as the Euro struggles against a firm U.S. Dollar. Recent data from the Eurozone, including weaker industrial output and slowing export activity, has fueled concerns about growth. Meanwhile, the U.S. Dollar continues to benefit from demand for safe-haven assets and ongoing uncertainty surrounding U.S. fiscal negotiations.

The Euro has been unable to gain momentum despite attempts to stabilize market sentiment. Concerns over Eurozone economic performance have weighed on the currency, particularly as inflation remains below target levels and manufacturing output continues to lag.

On the other hand, the U.S. Dollar retains broad support due to cautious risk sentiment and expectations that the Federal Reserve will maintain a relatively tighter monetary stance compared to the European Central Bank. With limited high-impact data releases scheduled, EURUSD is likely to remain driven by broader dollar strength and market positioning.

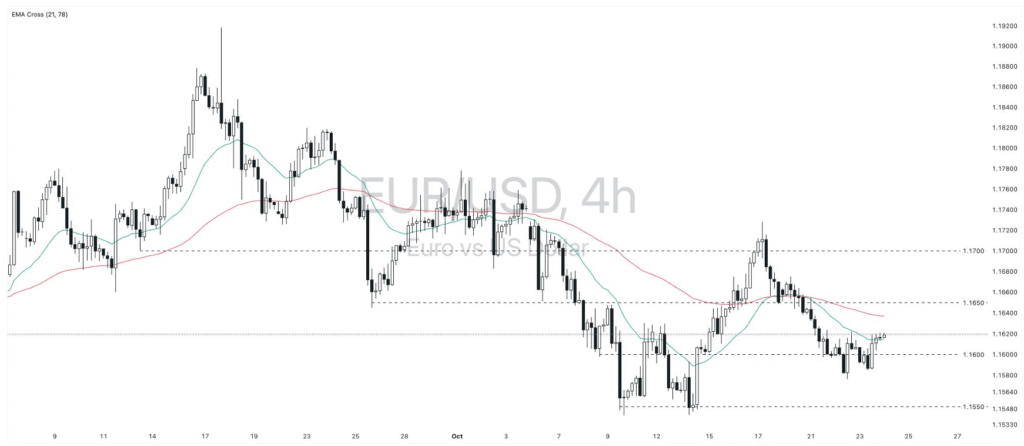

EURUSD is currently trading below both converging exponential moving averages, suggesting that the short-term trend remains weak. Price action shows reluctance to break higher, maintaining a bearish tone unless key resistance levels are reclaimed.

- Resistance 1 (R1): 1.1550

- Resistance 2 (R2): 1.1650

- Support 1 (S1): 1.1500

- Support 2 (S2): 1.1450

- Close: 1.1528

A sustained move below 1.1500 may expose EURUSD to deeper downside pressure toward 1.1450. Conversely, a recovery back above 1.1550 would be the first indication that momentum could shift back toward 1.1650, though such a move may require catalysts from data or central bank commentary.

As long as EURUSD remains below the resistance zone and Eurozone data continues to underwhelm, the bias remains tilted to the downside. Traders should monitor U.S. inflation expectations, bond yields, and upcoming statements from the Federal Reserve and ECB for new directional cues.

Source: Exness Daily Commentary – 24 October 2025. For informational purposes only.

Get real-time market insights and AI-generated trade setups using Smart Trader Pro.

Open Smart Trader Pro