EURUSD Analysis Today 28-10-2025- Technical Overview and Market Outlook

The EURUSD analysis today shows the pair stabilizing around the key support area near 1.1550, after experiencing a moderate pullback in recent sessions. Market sentiment remains cautious, as traders assess upcoming economic data and central bank statements for directional clues.

The Euro’s performance is currently influenced by shifting risk sentiment and expectations surrounding monetary policy. Meanwhile, the U.S. Dollar continues to react to changes in interest rate outlook and macroeconomic developments, contributing to mixed price volatility in the pair.

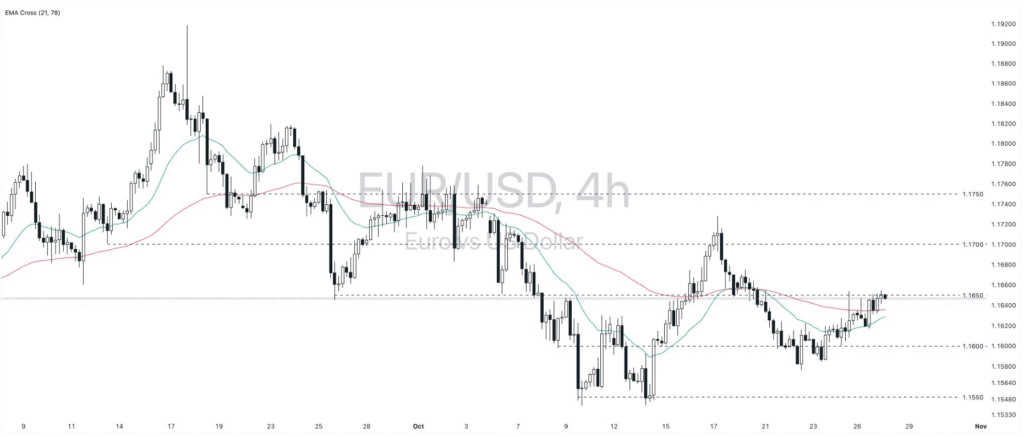

- Resistance R1: 1.1700

- Resistance R2: 1.1750

- Support S1: 1.1550

- Support S2: 1.1500

- Previous Close: 1.1651

A sustained hold above 1.1550 may support a short-term rebound toward 1.1700. However, failure to maintain this zone could open the door for a further decline toward 1.1500, where additional demand may start to appear.

For now, the overall bias remains neutral, with traders awaiting clearer drivers from economic data releases, inflation readings, and central bank policy signals.

The Euro continues to track broader shifts in risk sentiment, while the Dollar remains sensitive to evolving interest rate expectations. Traders will closely monitor upcoming statements from the Federal Reserve and European Central Bank, as these could provide renewed direction for the pair.

Source: Exness Daily Market Commentary – October 28, 2025.

Analyze EURUSD, gold, indices, and crypto in real-time with Smart Trader Pro — AI-powered trading intelligence.

Open Smart Trader Pro