EURUSD Analysis – Euro Holds Steady Amid Market Uncertainty

The EURUSD analysis October 22 2025 shows that the euro continues to struggle near the 1.1600 level as weak eurozone data and a stronger US dollar weigh on sentiment. According to Exness reports, the pair closed at 1.1599 after failing to maintain earlier gains, reflecting cautious market sentiment amid mixed risk appetite.

Industrial production and exports in the eurozone declined sharply, raising concerns about the region’s growth outlook. Meanwhile, the dollar remains supported by stable Treasury yields and expectations that the Federal Reserve will keep interest rates elevated for longer.

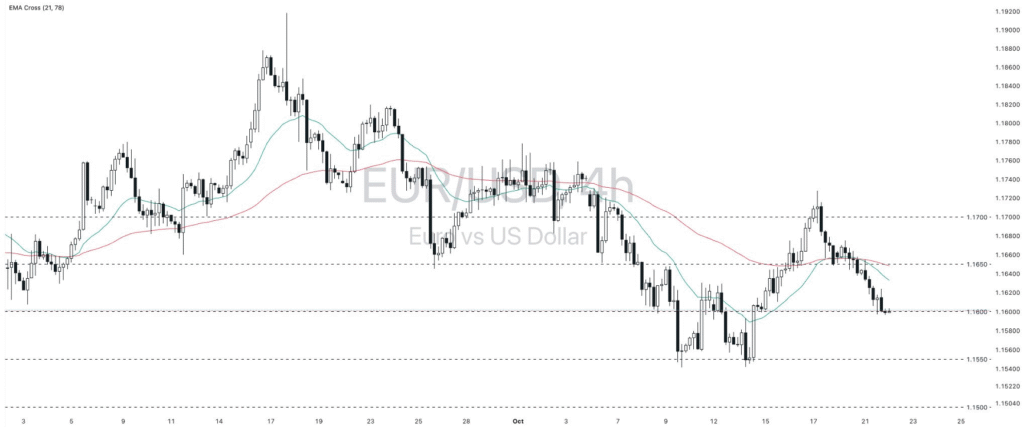

On the technical side, EURUSD trades within a neutral-to-bearish range between 1.1500 and 1.1700. The immediate resistance levels are at 1.1650 and 1.1700, while support lies at 1.1550 and 1.1500. A break below 1.1550 could accelerate downside momentum toward the lower boundary of the channel, whereas a move above 1.1650 may open the path to recovery.

The overall bias remains neutral with a slight bearish tilt, as traders await stronger catalysts from US economic data and ECB statements later this week.

The EURUSD analysis October 22 2025 indicates that sentiment remains fragile, with traders cautious about positioning ahead of the upcoming inflation reports. Unless eurozone fundamentals improve, the pair could continue oscillating within the 1.15–1.17 range.

For live AI-based forex insights, visit Smart Trader Pro — the intelligent trading tool by ForexMarketPlace.

Disclaimer: Market data and analysis derived from Exness daily commentary, verified on October 22, 2025. The content is for educational purposes only and not investment advice.

Enhance your forex strategy with Smart Trader Pro — your AI-powered market assistant from ForexMarketPlace.

Open Smart Trader Pro