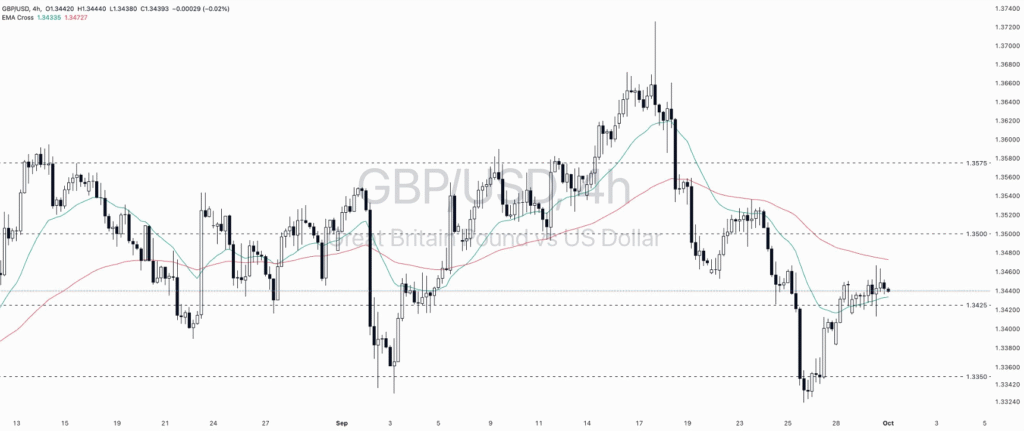

GBPUSD Analysis – October 1, 2025

Weak UK Data but Sterling Supported by Dollar Weakness

On October 1, 2025, GBPUSD managed to close slightly higher despite disappointing UK macroeconomic indicators. The UK’s current account deficit widened sharply to £28.9 billion in Q2, business investment fell by 1.1%, and quarterly GDP slowed by 0.3%, although annual growth was revised to 1.4%.

These figures highlight ongoing economic fragility in the UK. However, the pair found support from broad USD weakness as US political risks and Fed policy uncertainty weighed on the dollar.

Technically, GBPUSD remained above the 1.3425 support level and the 21 EMA (exponential moving average). Price is consolidating between converging moving averages, suggesting an upcoming breakout.

Key Technical Levels and Trade Opportunities

📊 Trading Setup (October 1, 2025):

- Buy Entry Zone: 1.3425 – 1.3450

- Take Profit 1: 1.3500

- Take Profit 2: 1.3575

- Stop Loss: 1.3350

- Sell Entry Zone: 1.3500 – 1.3520

- Take Profit 1: 1.3440

- Take Profit 2: 1.3350

- Stop Loss: 1.3575

Overall, GBPUSD shows limited upside given weak UK fundamentals, but dollar weakness may provide near-term support.