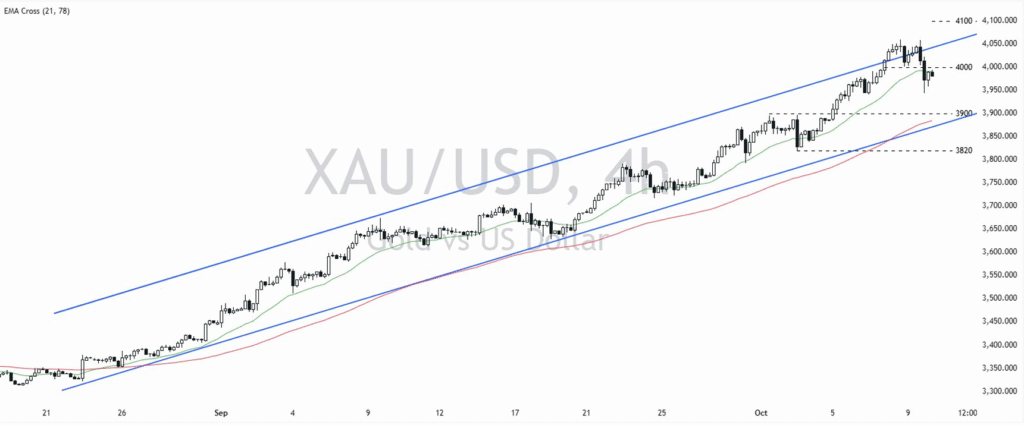

Gold (XAU/USD) Faces Resistance – Trading Levels and Risk Scenarios

Gold (XAU/USD) ended the week around $3990, trading below major resistance near $4000–$4100. The metal remains pressured as U.S. yields stay elevated, but safe-haven bids keep downside limited. This tug-of-war leaves gold trapped inside a broad range, with directional conviction likely returning only after next week’s inflation data.

Investors continue to weigh a stubborn inflation outlook against the prospect of slower growth. U.S. Treasury yields remain near multi-year highs, reinforcing a “higher for longer” stance by the Fed. Meanwhile, geopolitical risk and central-bank demand offer occasional support. As a result, gold trades in choppy conditions — fading rallies and finding buyers on dips.

The structure is bearish-to-neutral in the near term. Price failed to sustain above the $4000 handle, printing a lower high beneath the $4100 cap. Momentum oscillators flatten, while moving averages point to consolidation. A decisive daily close below $3900 could extend weakness toward $3820, whereas reclaiming $4000–$4100 would shift focus back to $4200.

Key Levels

R2: 4100 • R1: 4000

S1: 3900 • S2: 3820

Close: 3990 (Bias: Bearish)

Buy Scenario

- Buy dips into 3900–3820 if H1 holds above 3900.

- Targets: 4000 first, extension to 4100.

- Invalidation: Hourly close below 3820.

Sell Scenario

- Sell rallies toward 4000–4100 resistance.

- Targets: 3900 and 3820.

- Invalidation: Hourly close above 4110.

- Position sizing should be modest as volatility around CPI could trigger gaps.

- Avoid trading mid-range noise; focus on clear support/resistance retests.

- Use tight stops and avoid stacking correlated USD trades simultaneously.

Why is gold struggling below $4000?

Strong Treasury yields and a firm dollar cap gold’s topside, limiting momentum despite solid safe-haven demand.

What could trigger a breakout?

A clear drop in U.S. yields or dovish central-bank tone could reintroduce bullish momentum toward 4200.

Is it better to trade short-term or hold positions?

Short-term trading around defined levels is preferable until gold breaks decisively from its current range.