Head and Shoulders Pattern: How to Trade the Most Famous Reversal Setup

The head and shoulders pattern is a classic reversal formation in technical analysis. It signals a shift from bullish to bearish momentum after an uptrend.

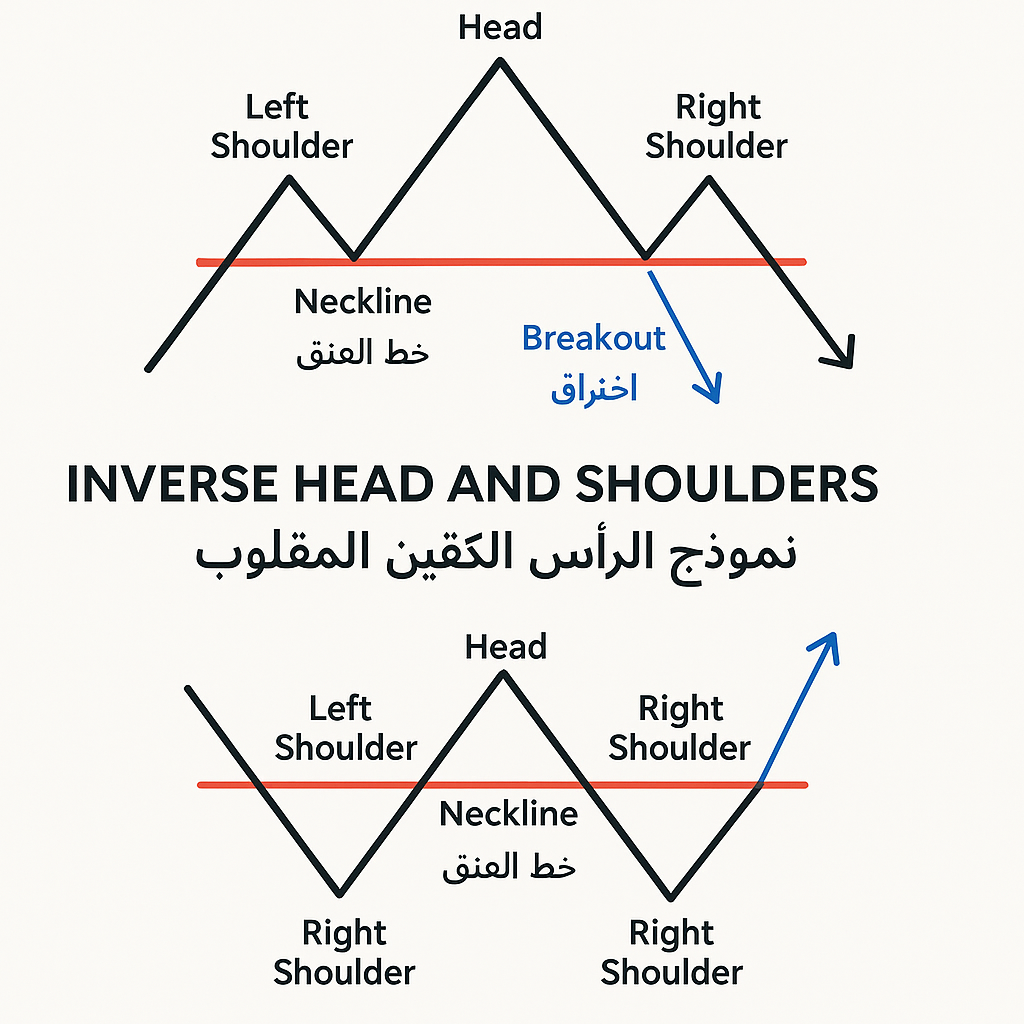

Structure of the Pattern

- Left Shoulder: A peak followed by a decline.

- Head: A higher peak followed by a decline.

- Right Shoulder: A lower peak showing weakness.

- Neckline: Support line connecting lows of the shoulders.

Trading the Pattern

Entry: Short when price breaks below the neckline.

Stop-Loss: Above the right shoulder.

Target: Measure head-to-neckline distance and project downward.

Inverse Head and Shoulders

Signals bullish reversal after a downtrend. Entry above neckline, stop-loss below right shoulder, target projected upward.

Common Mistakes

- Entering before neckline break.

- Ignoring volume confirmation.

- Confusing random peaks with valid shoulders.

Conclusion

The head and shoulders pattern is one of the most reliable tools for spotting market reversals. Learn more from Investopedia.