Rising and Falling Wedge Patterns: Compression Setups Explained

Wedge patterns are technical formations where price contracts between two converging lines. They often precede reversals or continuations depending on breakout direction.

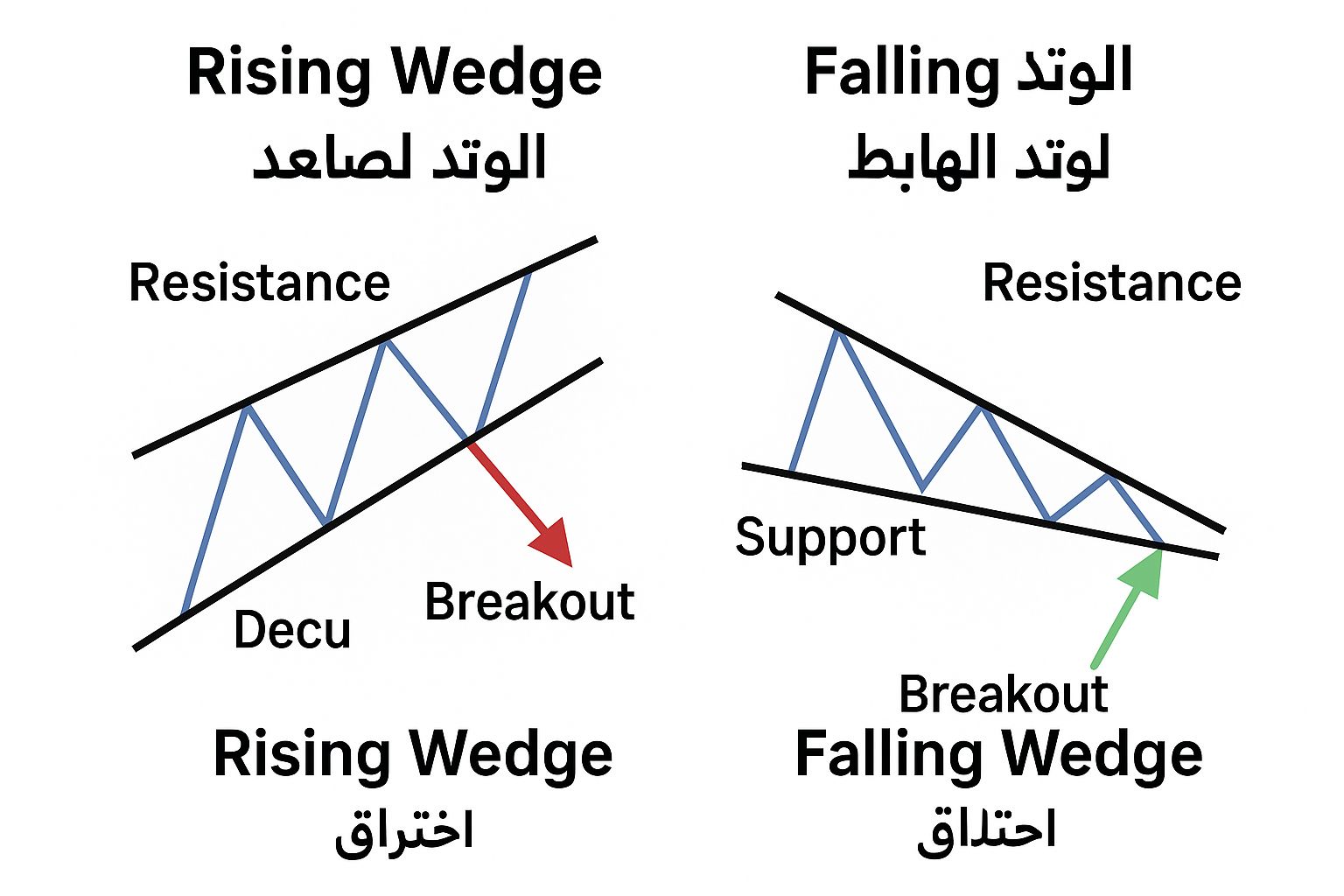

Rising Wedge (Bearish)

Characterized by upward-sloping support and resistance lines, with support steeper. Indicates weakening bullish strength.

How to Trade

Entry: Short on breakout below support line.

Stop-Loss: Above the last swing high.

Target: Project wedge height downward.

Falling Wedge (Bullish)

Formed by downward-sloping converging lines, with resistance steeper. Signals weakening selling pressure.

How to Trade

Entry: Buy on breakout above resistance line.

Stop-Loss: Below the last swing low.

Target: Project wedge height upward.

Common Mistakes

- Trading before breakout.

- Ignoring volume confirmation.

- Confusing wedges with channels.

Conclusion

Rising and falling wedge patterns offer high-probability setups when confirmed by volume. Learn more at Investopedia.