US Dollar Index (DXY) Analysis – October 1, 2025

Shutdown Fears and Job Market Stability Shape DXY Outlook

The US Dollar Index (DXY) edged lower on October 1, 2025, as investors weighed the risk of a potential government shutdown against mixed labor market data. Although job openings in August stabilized at 7.2 million and layoffs declined, the slowdown in hiring momentum continues to pressure the greenback.

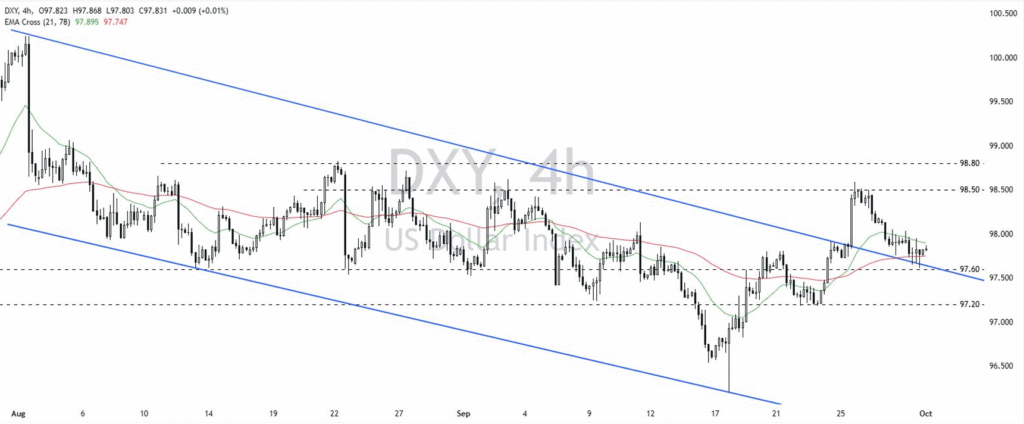

Political uncertainty in Washington has further dampened sentiment, with traders increasingly cautious about taking long USD positions until clarity emerges. From a technical standpoint, the DXY retested a broken channel and remains between its 21 and 50 exponential moving averages, signaling potential volatility.

If the index maintains its footing above 97.20, it could reattempt a rally toward 98.50, a strong resistance level. Conversely, a failure to hold this support zone might open the way for deeper pullbacks, with sellers eyeing the 96.90 region.

Technical Levels and Trading Opportunities

📊 Trading Setup (October 1, 2025):

- Buy Entry Zone: 97.20 – 97.30

- Take Profit 1: 97.80

- Take Profit 2: 98.50

- Stop Loss: 96.90

- Sell Entry Zone: 98.40 – 98.50

- Take Profit 1: 97.80

- Take Profit 2: 97.20

- Stop Loss: 98.80

Overall, DXY shows short-term weakness but retains a medium-term bullish bias if support holds. Traders should monitor US political developments closely, as any resolution to the shutdown standoff could quickly shift momentum.