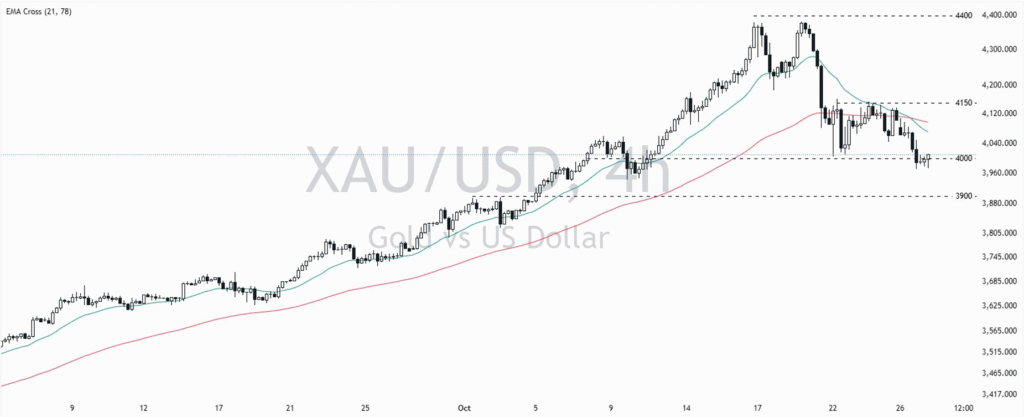

Gold Analysis XAUUSD – 28-10-2025

Gold (XAUUSD) continued to move lower during the latest session, retesting the major psychological support area near 4000. The recent crossover of the exponential moving averages signals a potential shift in short-term momentum, as traders assess whether buyers can defend this level or whether bearish pressure will dominate.

Market sentiment remains mixed, influenced by fluctuating risk appetite and ongoing geopolitical developments. Reduced trade tensions may temporarily weigh on safe-haven demand, yet lingering uncertainty and cautious investor positioning continue to limit downside follow-through.

- Resistance R2: 4400

- Resistance R1: 4150

- Support S1: 4000

- Support S2: 3900

- Previous Close: 4010

If gold closes below 4000, the next downside target may form near 3900, where buyers could look to regroup. On the other hand, maintaining price action above 4000 may enable a recovery toward 4150, followed by a possible extension toward 4400 if bullish momentum strengthens.

However, the wider market structure suggests a neutral bias for now, with directional conviction likely to emerge only after stronger macroeconomic drivers or a sustained break above/below the current range.

Gold price action continues to reflect broader macro uncertainty. While optimism surrounding trade discussions may temporarily reduce safe-haven inflows, ongoing geopolitical and fiscal risk keeps volatility elevated. Traders may look closely at upcoming central bank statements and global inflation data for guidance.

Source: Exness Daily Market Commentary – October 28, 2025.

Analyze gold, currencies, indices & crypto with Smart Trader Pro — your AI-powered trading companion from ForexMarketPlace.

Open Smart Trader Pro