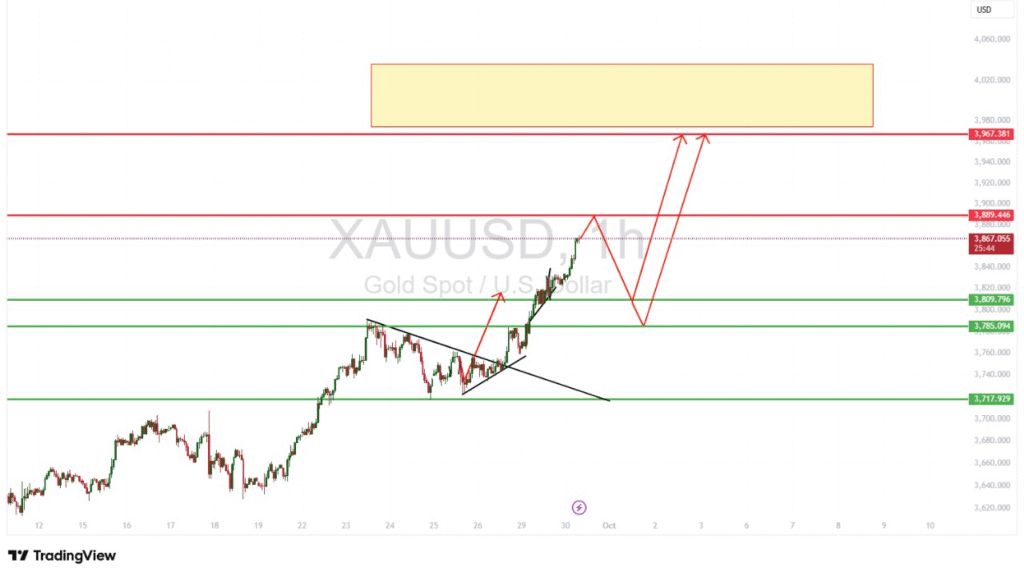

XAUUSD Gold Price Analysis – September 30, 2025

Gold prices continued their strong bullish rally, currently trading around $3867/oz. The breakout above key technical levels shows strong buying momentum as investors seek safe-haven assets amid global uncertainty.

Key Resistance Levels

- $3889 – Short-term resistance

- $3967 – $4020 – Major resistance zone

Key Support Levels

- $3809 – First corrective support

- $3785 – Medium-term support

- $3717 – Major support (trend reversal zone)

Expected Scenarios

- Direct rally towards $3967 – $4020.

- Pullback to $3809 – $3785 before resuming uptrend.

Fundamental Overview

Geopolitical tensions and weak USD continue to support gold. Markets are awaiting U.S. economic data this week, which may define the short-term direction.

Outlook

Gold is expected to remain bullish in the short to medium term. If price stabilizes above $3889, the $4000 target could be reached in October 2025.

FAQs

Q1: What is the current trend for gold?

Bullish, with possible short-term correction.

Q2: What is the key resistance level?

The $3967 resistance is crucial.

Q3: Could gold break above $4000?

Yes, if momentum continues above $3889.

Q4: Best buying zones?

Between $3809 – $3785 with stop-loss under $3717.

Q5: Is technical analysis enough?

No, fundamental analysis must also be considered.

Q6: How does USD affect gold?

A weaker USD usually supports gold prices.