EURUSD Analysis – October 1, 2025

Stronger Eurozone Inflation Supports Euro

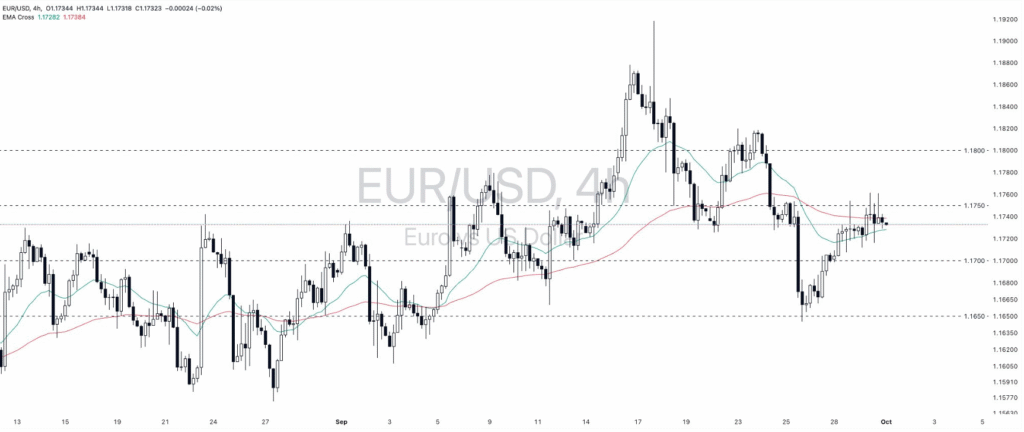

On October 1, 2025, the EURUSD pair closed marginally higher after choppy sessions as traders assessed stronger inflation data from Germany and France. German CPI rose to 2.4% YoY in September, while French CPI climbed to 1.2% from 0.9%.

These figures reinforced expectations that the European Central Bank (ECB) will maintain its current monetary stance, offering support to the euro. However, EURUSD remains vulnerable to US political risks and Fed policy signals.

Technically, EURUSD traded near its exponential moving averages and briefly touched 1.1750 resistance. The pair remains range-bound, awaiting a breakout for clearer direction.

Key Technical Levels and Trading Opportunities

📊 Trading Setup (October 1, 2025):

- Buy Entry Zone: 1.1700 – 1.1730

- Take Profit 1: 1.1750

- Take Profit 2: 1.1800

- Stop Loss: 1.1650

- Sell Entry Zone: 1.1790 – 1.1800

- Take Profit 1: 1.1750

- Take Profit 2: 1.1700

- Stop Loss: 1.1825

EURUSD shows neutral to slightly bullish sentiment, with upside potential if inflation momentum in the Eurozone continues.