US Dollar Index (DXY) — October 2, 2025

Fundamental Outlook: Shutdown Fears and Weak Jobs Data

Fundamental Outlook :

The US dollar continued to trade nervously on October 2, 2025, as mounting political tension surrounding a possible government shutdown rattled investor sentiment. White House budget warnings suggested imminent layoffs and deep budget cuts in infrastructure and renewable projects. President Trump doubled down, framing the funding freeze as an opportunity to slash federal jobs and suspend billion-dollar programs.

At the same time, economic data added to the unease. ADP employment numbers shocked markets with a net loss of 32,000 jobs in September, far below expectations of +45K. While the ISM Manufacturing PMI edged higher to 49.1 from 48.7, the improvement was too modest to offset broader concerns about slowing growth.

Together, these developments left the dollar under pressure, with traders cautious ahead of delayed releases of weekly jobless claims and the all-important nonfarm payrolls.

Technical View: DXY Consolidates Near Resistance

Technical View:

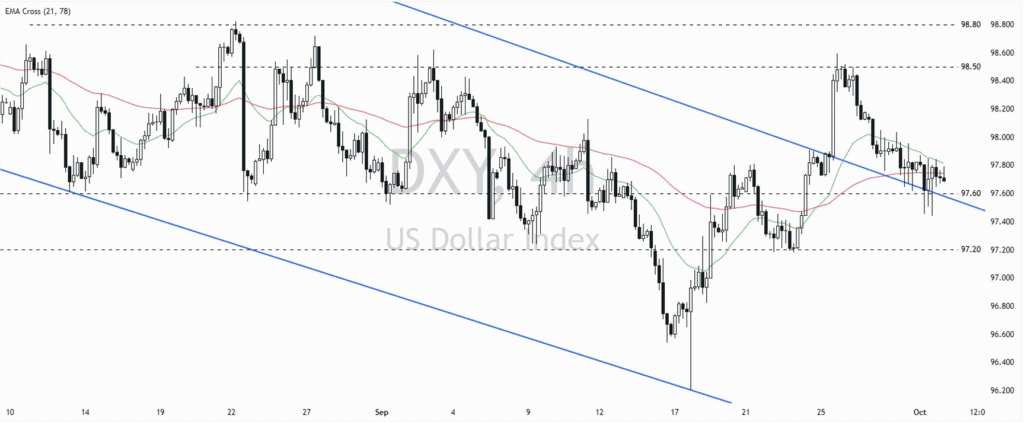

From a chart perspective, the Dollar Index closed at 97.71, clinging to the top of its channel but showing signs of fatigue. The price remains pinned between 97.60 support and 98.50 resistance, with converging EMAs highlighting the consolidation phase. Bulls need a break above 98.80 to regain momentum, while a slip below 97.20 could quickly flip sentiment to bearish.

Trading Plan:

- Buy Entry Zone: 97.60 – 97.80

- TP1: 98.50

- TP2: 98.80

- SL: 97.20

- Sell Entry Zone: 98.50 – 98.80

- TP1: 97.60

- TP2: 97.20

- SL: 99.00

Bias: The dollar is caught in a holding pattern; upside is capped unless 98.80 breaks, while downside opens below 97.20.