Gold Price (XAUUSD) — October 2, 2025

Fundamental Outlook: Shutdown Risks Keep Safe-Haven Demand Strong

📰 Fundamental Outlook:

Gold prices remained elevated on October 2, 2025, trading just shy of record highs, as investors continued to flock to safe-haven assets amid political uncertainty in the US. Shutdown fears deepened following warnings of large-scale federal layoffs and massive budget cuts.

Despite brief profit-taking, demand for gold persisted as a hedge against both political instability and weaker US labor market data. The ADP jobs report, showing a surprise 32,000 job loss, combined with ongoing budget risks, reinforced gold’s role as a defensive asset.

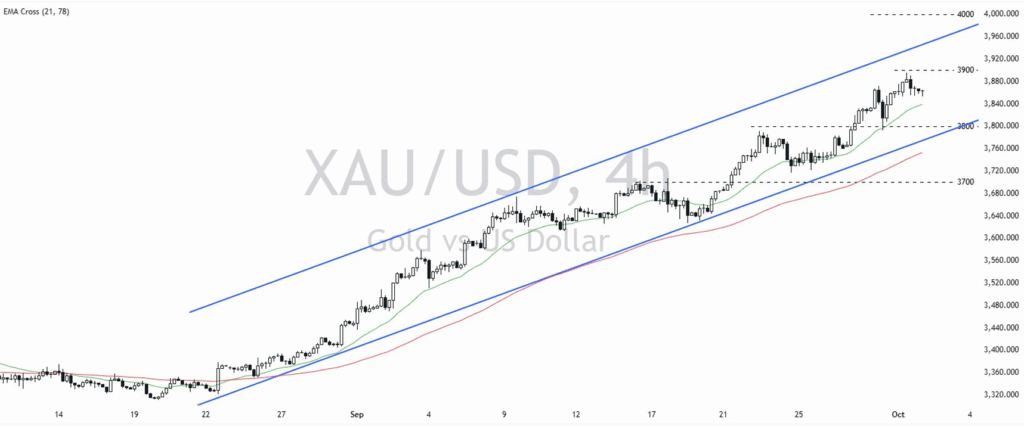

Technical View: Gold Consolidates Near Highs

📊 Technical View:

XAUUSD hovered above the crucial 3800 support, consolidating after a strong run-up. Price action suggests the market is pausing before its next move, with resistance seen near 3870 and psychological barriers at 4000. Momentum indicators remain bullish, though shorter-term charts show potential for pullbacks that could attract dip buyers.

💹 Trading Plan (October 2, 2025):

- Buy Entry Zone: 3800 – 3820

- TP1: 3870

- TP2: 4000

- SL: 3775

- Sell Entry Zone (scalp): 3980 – 4000

- TP1: 3920

- TP2: 3850

- SL: 4020

👉 Bias: Gold remains bullish above 3800; a sustained push above 3870 could open the path to retesting 4000.