GBPUSD Analysis – Pound Consolidates below Key Resistance amid Market Uncertainty

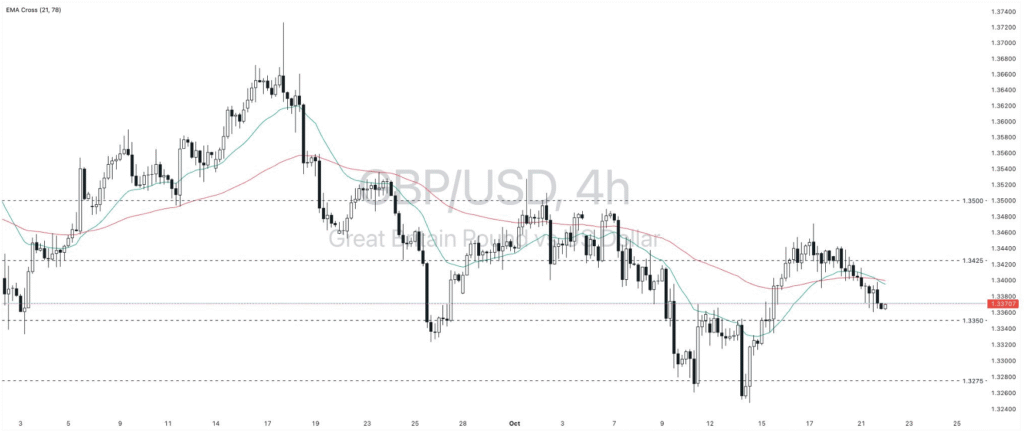

The GBPUSD analysis October 22 2025 shows that the British pound traded lower against the US dollar, closing near 1.3365 after failing to break above key resistance at 1.3425. According to Exness market data, the pair remains under moderate pressure as investors weigh ongoing fiscal concerns in the UK and persistent US dollar strength.

The UK government’s rising borrowing levels have raised questions about fiscal sustainability, while softer economic indicators in recent weeks have limited the pound’s upside potential. Meanwhile, the US dollar remains supported by strong Treasury yields and expectations that the Federal Reserve will maintain a restrictive policy stance.

From a technical perspective, GBPUSD continues to trade within a sideways consolidation range, with resistance levels at 1.3425 and 1.3500, and support levels at 1.3350 and 1.3275. A daily close below 1.3350 could open the door to further downside toward 1.3275, while a rebound above 1.3425 may signal renewed bullish momentum toward 1.3500.

The broader trend remains neutral, reflecting market indecision between dollar resilience and sterling’s attempts to recover. Short-term traders may continue to find opportunities within this defined 1.3275–1.3500 range.

The GBPUSD analysis October 22 2025 indicates that sentiment remains cautious ahead of upcoming UK fiscal data and US GDP releases. A stronger dollar could keep the pair under pressure, while any improvement in UK growth expectations may provide short-term relief for the pound.

For AI-assisted forex forecasts and real-time insights, visit Smart Trader Pro — your trading companion from ForexMarketPlace.

Disclaimer: Data and levels sourced from Exness daily report, verified on October 22, 2025. This analysis is for educational purposes only and does not constitute investment advice.

Follow daily forex insights with Smart Trader Pro — the AI-powered tool by ForexMarketPlace.

Open Smart Trader Pro