GBPUSD Technical Analysis Today – Key Levels and Outlook 24-10-2025

The GBPUSD technical analysis today shows that the pair is trading near 1.3326 after pulling back from recent highs. Despite holding above recent lows, the British Pound continues to face pressure from deteriorating business sentiment in the UK, highlighted by a decline in the CBI Business Optimism Index to -31. This reflects weakening outlook expectations across key industrial and manufacturing sectors.

Broad macroeconomic uncertainty continues to weigh on the British Pound. Softer domestic business surveys and declining new order volumes have raised concerns over growth momentum within the UK. Meanwhile, policymakers at the Bank of England remain divided on how U.S. tariff policies may influence inflation going forward, adding another layer of uncertainty.

On the other side of the pair, the US Dollar continues to benefit from cautious global risk sentiment, keeping USD demand relatively firm even as markets await additional data signals.

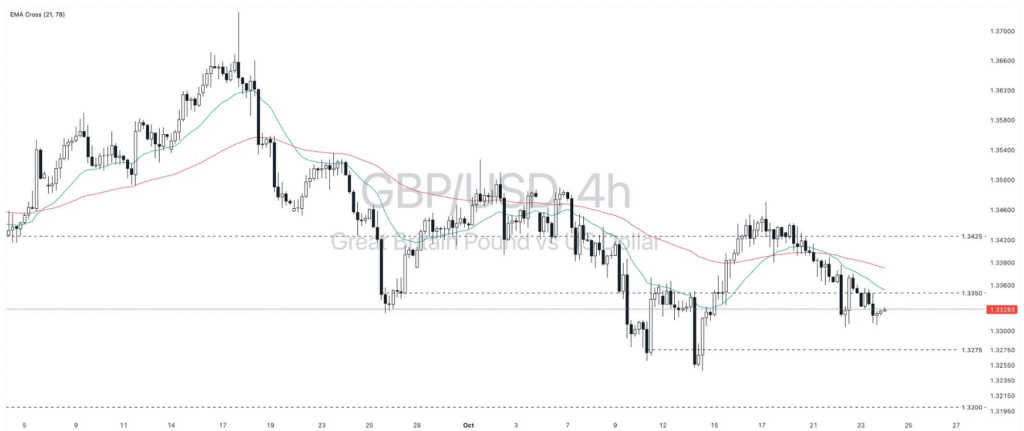

GBPUSD is currently trading between short-term exponential moving averages, suggesting that the pair remains in a consolidation phase. Price action continues to respect key horizontal levels, with no decisive breakout in either direction yet.

- Resistance 2 (R2): 1.3425

- Resistance 1 (R1): 1.3350

- Support 1 (S1): 1.3275

- Support 2 (S2): 1.3200

- Close: 1.3326

If GBPUSD remains below 1.3350, the pair is likely to continue trading within the 1.3350–1.3275 range. A sustained break above 1.3350 may open the door for a move toward 1.3425. Conversely, a close below 1.3275 could shift momentum downward toward 1.3200.

The broader trend remains neutral, with directional cues expected from upcoming UK economic sentiment releases and commentary from Bank of England policymakers. Traders should monitor market tone closely, especially shifts in USD strength.

Source: Exness Daily Commentary – 24 October 2025. For informational purposes only.

Get real-time strategy insights and AI-powered trade levels with Smart Trader Pro.

Open Smart Trader Pro