USDJPY Technical Analysis Today – Key Levels and Outlook 24-10-2025

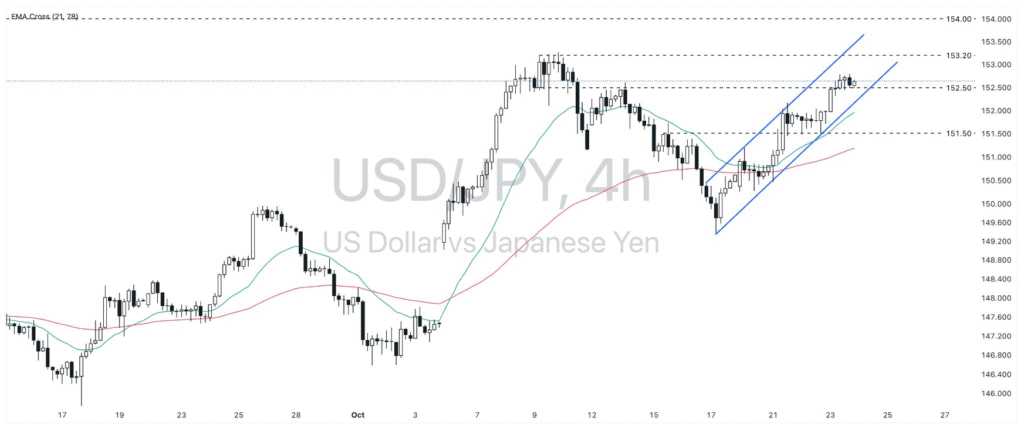

The USDJPY technical analysis today shows the pair trading near 152.64, maintaining a strong bullish structure. The price continues to move within an ascending channel, supported by diverging monetary policy expectations between the Federal Reserve and the Bank of Japan.

Markets are pricing in a longer period of higher interest rates in the United States, while the Bank of Japan remains cautious about policy normalization. This widening policy gap continues to pressure the Japanese Yen.

- Resistance 2 (R2): 154.00

- Resistance 1 (R1): 153.20

- Support 1 (S1): 152.50

- Support 2 (S2): 151.50

- Close: 152.64

If USDJPY remains above 152.50, bullish momentum may continue, allowing price to challenge 153.20 and possibly 154.00. Conversely, a daily close below 152.50 could trigger a pullback toward 151.50, though broader momentum remains upward.

As long as the policy divergence remains intact, the broader trend stays bullish. Traders should watch U.S. CPI data and Bank of Japan statements for clues on volatility risk.

Source: Exness Daily Commentary – 24 October 2025. For analysis purposes only.

For AI-powered signals and trade levels, use Smart Trader Pro.

Open Smart Trader Pro