USDJPY Analysis – October 1, 2025

Japanese Business Confidence Boosts Yen

On October 1, 2025, the Japanese yen strengthened as the Bank of Japan’s Tankan survey revealed improving sentiment among major manufacturers. The index rose to 14, marking its second consecutive gain, led by ceramics and shipbuilding sectors.

This boosted expectations that the BoJ may consider tightening policy this month, especially amid recent political stability and easing trade tensions after US tariff cuts.

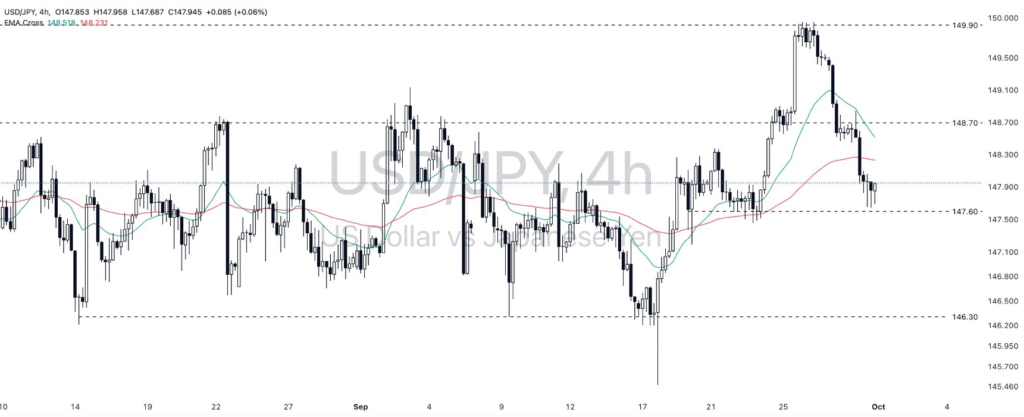

Technically, USDJPY fell back after retesting resistance at 148.70 and the 21 EMA. The price now trades below both short- and medium-term moving averages, with bearish momentum signaling possible further declines.

Key Technical Levels and Trade Opportunities

📊 Trading Setup (October 1, 2025):

- Sell Entry Zone: 147.60 – 147.90

- Take Profit 1: 146.80

- Take Profit 2: 146.30

- Stop Loss: 148.70

- Buy Entry Zone: 146.30 – 146.50

- Take Profit 1: 147.00

- Take Profit 2: 147.60

- Stop Loss: 145.90

USDJPY currently shows bearish momentum, with sellers likely to stay in control if the pair holds below 147.60.